A Partner in Thought: Why AI Will Make Financial Professionals More Valuable Than Ever

The financial sector is undergoing a profound transformation driven by the rise of AI technologies. This new era promises unprecedented efficiency and insight with significant economic implications. According to McKinsey, generative AI could add between $200 billion and $340 billion annually to the global banking sector. An IBM study reveals that 57% of banking and financial markets CEOs view generative AI as crucial for gaining a competitive edge, with 66% believing the productivity gains justify the associated risks.

The impact of AI adoption is already evident: financial institutions leading in AI and digital capabilities achieved an average annual total shareholder return (TSR) of 8% between 2018 and 2022, outperforming their peers who only managed 5%.

These statistics, while impressive, have sparked widespread concerns about job displacement across various industries. The financial services sector is no exception, with many workers fearing that AI may render their roles obsolete, threatening their job security and career prospects.

This fear, while understandable, may be misplaced. Instead of replacing finance professionals, AI has the potential to make them more valuable than ever by augmenting their skills and increasing the necessity for strong judgment. The key lies in understanding how to harness AI as a powerful tool that complements human expertise rather than supplants it.

The Evolving Role of Finance Professionals: A History of Adaptation

Throughout history, finance professionals have consistently adapted to technological changes:

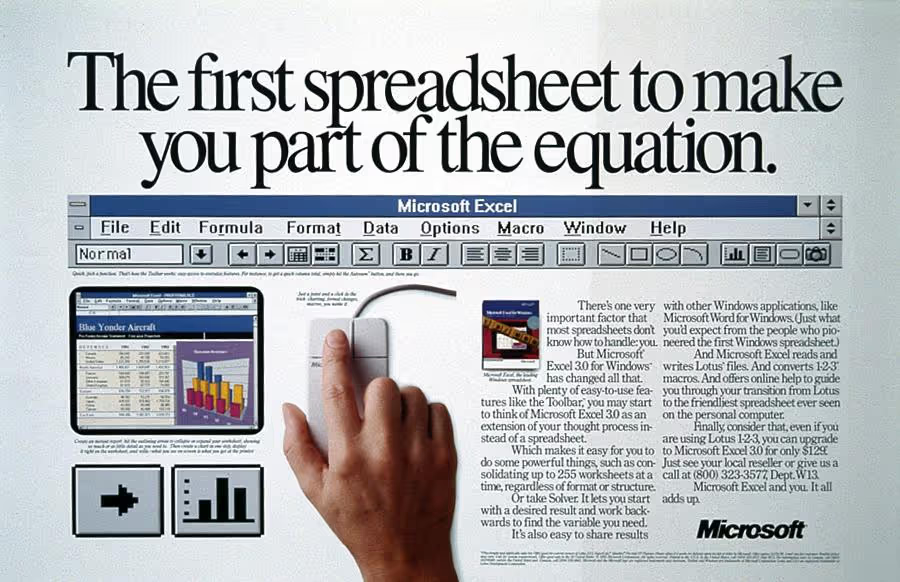

- 1980s: PCs and spreadsheet software like VisiCalc, Lotus 1-2-3 and Microsoft Excel revolutionized financial modeling.

- 1990s: The internet brought real-time data access and electronic trading.

- 2000s: Advanced software automated routine analysis tasks.

- 2010s: Big data and machine learning enhanced forecasting and risk analysis.

With each innovation, rather than becoming obsolete, financial analysts have moved up the value chain. They've focused on strategic insights and decision-making, learning new tools to complement their expertise. AI represents the next step in this evolution, not a replacement for human expertise.

The Critical Role of Human Oversight: Why AI Can't Replace the Pros

It's natural to worry that AI might make certain roles obsolete. After all, if AI can process vast amounts of data and generate insights in seconds, where does that leave the human analyst?

But just as spreadsheets didn't eliminate accountants but rather made them more efficient, AI tools like Brightwave are set to amplify financial experts’ capabilities, not diminish them. Here's why:

AI Augments, Not Automates

AI excels at processing vast amounts of data and identifying patterns, but it lacks the nuanced understanding of real-world contexts that humans possess. Financial professionals play a crucial role in interpreting AI-generated insights within the broader economic and geopolitical landscape, assessing the practical implications of AI findings for specific clients or investment strategies, as well as recognizing when AI-suggested trends may be anomalies rather than actionable insights.

For example, AI might flag a sudden increase in a company's revenue as a positive indicator. However, a seasoned financial analyst would consider factors like one-time events, changes in accounting practices or broader industry trends before making a recommendation.

The Human Touch Remains Crucial

Clients and stakeholders still value face-to-face interactions, empathy and the ability to explain complex financial concepts in relatable terms. AI can generate reports and analyses, but it cannot replicate the nuanced communication, empathy and relationship-building skills that are central to many financial roles. The capacity to translate technical information into actionable insights tailored to the specific needs and understanding of one’s audience remains a uniquely human skill.

Ethical Oversight Is More Important Than Ever

As AI becomes more prevalent in financial decision-making, human involvement is paramount to ensure ethical practices and mitigate biases. Human professionals are essential for ensuring AI-driven analyses comply with regulatory requirements and industry standards, balancing profit motives with social responsibility and long-term sustainability and making ethical judgments that AI cannot, especially in gray areas. AI systems can inadvertently perpetuate or amplify biases present in their training data. Having a human expert in the loop is critical for recognizing potential biases in AI outputs and adjusting analyses accordingly, ensuring diverse perspectives are considered in financial decision-making.

Ensuring transparency and accountability by verifying AI data against primary sources is another critical function that requires human judgment. Financial professionals play a vital role in cross-referencing AI-generated insights with primary sources, industry reports and your own expertise. This verification and validation process adds a layer of accountability that is essential in the high-stakes world of finance.

Creativity and Innovation Still Reign Supreme

An AI might provide data-driven insights about market trends, but it takes human creativity to envision a novel financial product that capitalizes on those trends while meeting specific client needs. Financial professionals excel at anticipating market shifts based on subtle cues or unconventional indicators, as well as crafting personalized financial solutions that consider a client's unique circumstances and goals. AI isn’t going to change that.

AI as a Partner in Thought

AI tools like Brightwave streamline the processing of large data sets and deliver actionable insights, significantly boosting decision-making capabilities and broadening research coverage. Brightwave processes data from a variety of sources, including SEC filings, earnings call transcripts and real-time news, allowing professionals to efficiently cover more companies, sectors and themes. This doesn't mean fewer jobs; it means each professional can deliver more value, focusing more on thinking strategically, crafting impactful investment theses and building client relationships, rather than sifting through data.

AI facilitates deeper analysis by linking disparate data points and unveiling hidden opportunities. Brightwave's advanced reasoning capabilities uncover complex relationships across data sources, highlighting trends and patterns that might elude traditional methods. The platform also suggests follow-up questions, encouraging users to delve deeper and make more informed decisions. But as AI uncovers complex trends and prompts deeper questions, it's the human analyst who interprets these insights, applying contextual understanding and strategic thinking that AI cannot replicate.

Embracing AI as a Career Accelerator

It's clear that the future belongs to those who embrace this technology as a partner, not a replacement. The synergy between human expertise and AI capabilities opens up new horizons in financial analysis and decision-making. As AI handles the heavy lifting of data processing and initial analysis, professionals are freed to focus on what truly matters: applying their unique human insights, ethical judgment and strategic thinking to complex financial challenges.

"You talk to the sharpest analysts, and they're extremely sophisticated people. I think it would be foolish to say that you're going to replace the sharpest, hardest working, most channel-checking investment research teams in the world.”

- Mike Conover, Brightwave CEO and Co-Founder

The future of finance isn't about humans versus AI; it's about humans and AI working together to achieve unprecedented levels of insight and efficiency. By embracing this partnership, professionals position themselves at the forefront of the industry, ready to tackle the complex financial challenges of tomorrow.

Ready to see how Brightwave can enhance your capabilities? Request a demo today and secure your place in the future of finance.

.avif)